Zhonghua Gas Holdings Limited's (HKG:8246) 111% Price Boost Is Out Of Tune With Revenues

Those holding Zhonghua Gas Holdings Limited (HKG:8246) shares would be relieved that the share price has rebounded 111% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 10% over that time.

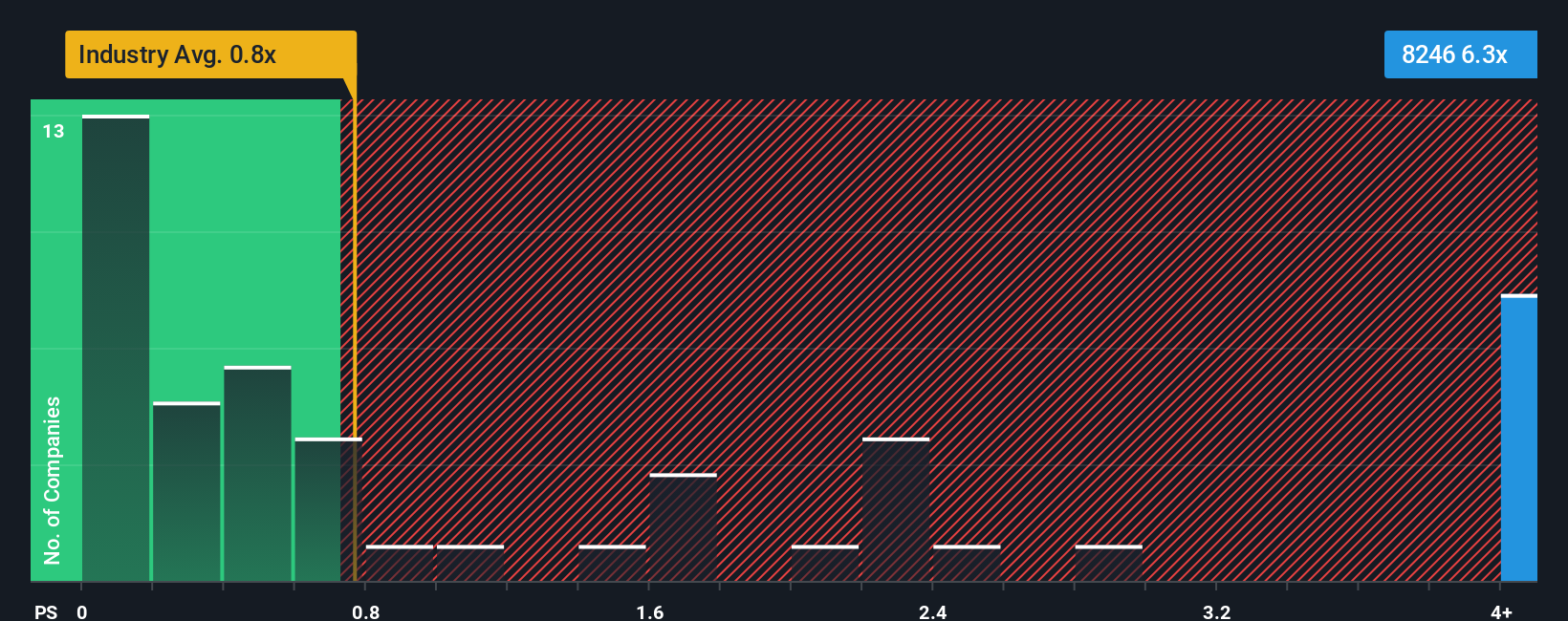

Following the firm bounce in price, given around half the companies in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Zhonghua Gas Holdings as a stock to avoid entirely with its 6.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Zhonghua Gas Holdings

How Zhonghua Gas Holdings Has Been Performing

We'd have to say that with no tangible growth over the last year, Zhonghua Gas Holdings' revenue has been unimpressive. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Zhonghua Gas Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Zhonghua Gas Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 75% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 0.4% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Zhonghua Gas Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Zhonghua Gas Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Zhonghua Gas Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Zhonghua Gas Holdings (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English