Asian Growth Stocks With Insider Ownership Expecting Up To 174% Earnings Growth

As global markets navigate through a landscape of mixed economic signals, Asia's growth stocks are capturing attention with their potential for significant earnings expansion. In this environment, companies with high insider ownership often stand out as they may align management interests with shareholder value, making them compelling considerations for investors seeking growth opportunities in the region.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.1% | 122.3% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's explore several standout options from the results in the screener.

Youzan Technology (SEHK:8083)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youzan Technology Limited is an investment holding company offering online and offline e-commerce solutions in the People's Republic of China, Japan, and Canada with a market cap of HK$6.99 billion.

Operations: The company's revenue segments include online and offline e-commerce solutions provided in the People’s Republic of China, Japan, and Canada.

Insider Ownership: 22.3%

Earnings Growth Forecast: 108.6% p.a.

Youzan Technology is forecasted to become profitable within three years, with earnings expected to grow significantly at 108.62% annually. Despite its high volatility and slower revenue growth of 2.9% compared to the Hong Kong market, it trades at a significant discount relative to estimated fair value. Recent buybacks totaling HK$30.46 million indicate potential confidence from management amidst improved financial performance, transitioning from a loss to a net income of CNY 72.74 million in H1 2025 due to operational efficiencies and strategic shifts.

- Take a closer look at Youzan Technology's potential here in our earnings growth report.

- According our valuation report, there's an indication that Youzan Technology's share price might be on the cheaper side.

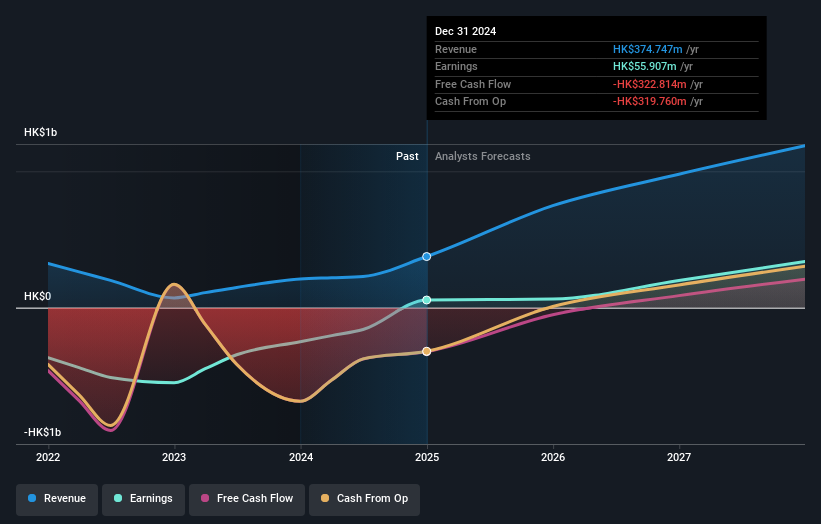

OSL Group (SEHK:863)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OSL Group Limited is an investment holding company that operates in the digital assets and blockchain platform sectors across Hong Kong, Australia, Japan, Singapore, and Mainland China with a market cap of HK$13.74 billion.

Operations: The company's revenue segment consists of HK$446.39 million from its digital assets and blockchain platform business.

Insider Ownership: 32.6%

Earnings Growth Forecast: 62.3% p.a.

OSL Group's revenue is expected to grow significantly at 43.7% annually, outpacing the Hong Kong market. However, insider activity shows substantial selling over the past three months and shareholders have faced dilution due to recent equity offerings totaling HK$4.57 billion. Despite becoming profitable this year, OSL reported a net loss of HK$40.2 million for H1 2025, highlighting challenges alongside its high growth trajectory in earnings forecasted at 62.3% annually.

- Delve into the full analysis future growth report here for a deeper understanding of OSL Group.

- Our expertly prepared valuation report OSL Group implies its share price may be too high.

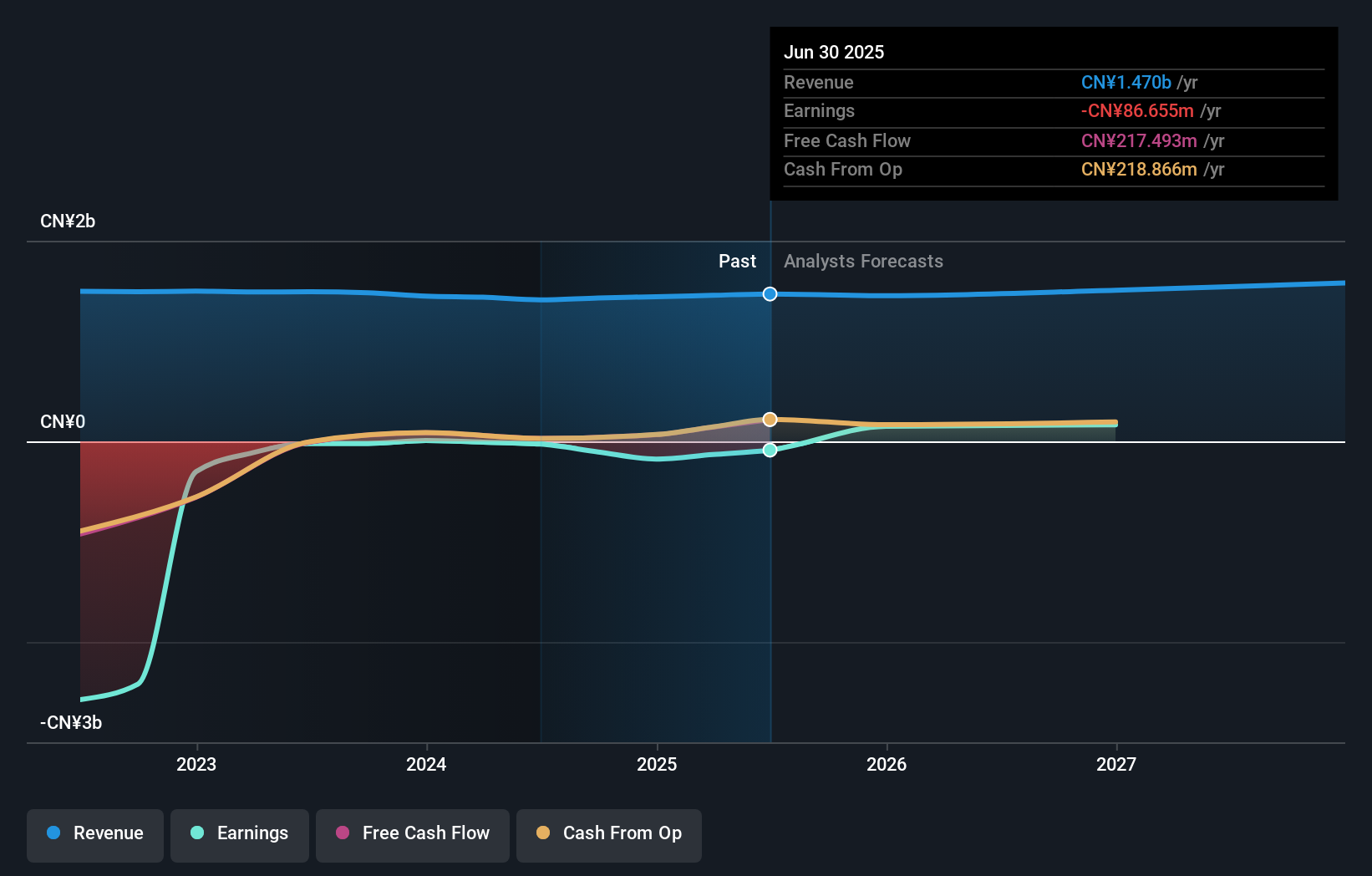

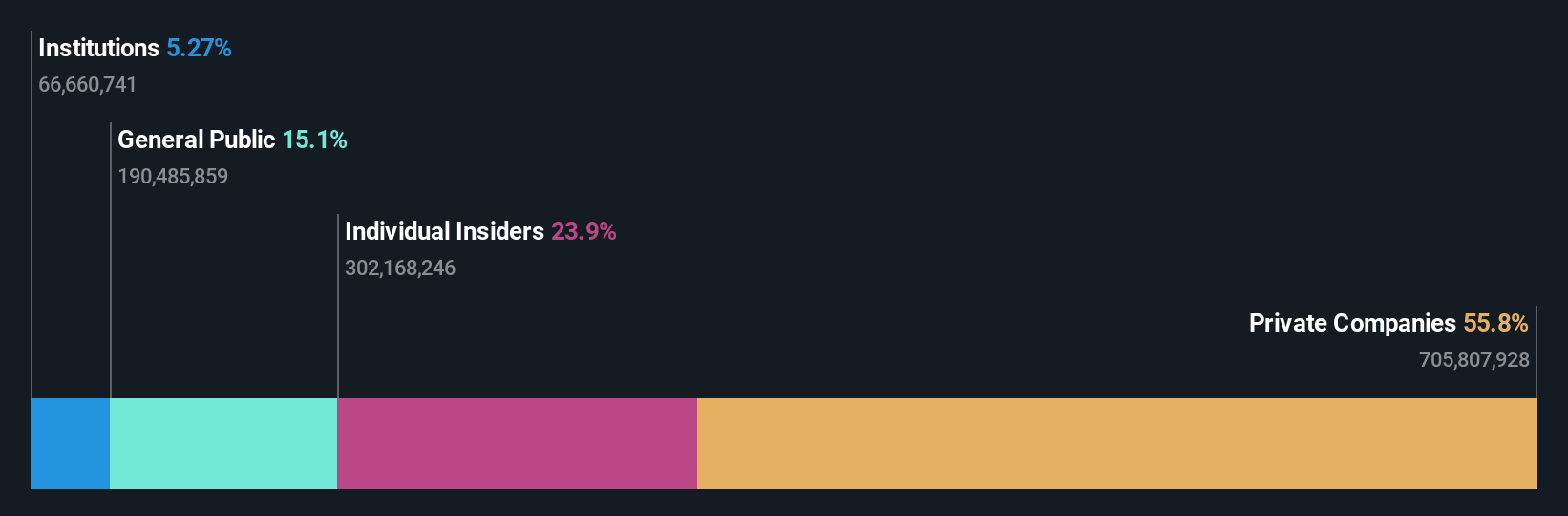

Beijing Wantai Biological Pharmacy Enterprise (SHSE:603392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. operates in the biotechnology sector, focusing on the development and production of diagnostic reagents and vaccines, with a market cap of CN¥71.54 billion.

Operations: Revenue segments for the company include diagnostic reagents and vaccines, aligning with its focus in the biotechnology sector.

Insider Ownership: 23.9%

Earnings Growth Forecast: 174.7% p.a.

Beijing Wantai Biological Pharmacy Enterprise is forecasted to achieve profitability within three years, with revenue growth expected at 25.7% annually, surpassing the Chinese market's average. Despite this promising outlook, recent earnings for H1 2025 reveal a net loss of CNY 144.04 million compared to a profit last year, alongside declining sales and revenue figures. There is no significant insider trading activity reported in the past three months.

- Navigate through the intricacies of Beijing Wantai Biological Pharmacy Enterprise with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Beijing Wantai Biological Pharmacy Enterprise is priced higher than what may be justified by its financials.

Where To Now?

- Delve into our full catalog of 616 Fast Growing Asian Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English