Beijing Beida Jade Bird Universal Sci-Tech Company Limited (HKG:8095) Looks Just Right With A 25% Price Jump

Beijing Beida Jade Bird Universal Sci-Tech Company Limited (HKG:8095) shares have continued their recent momentum with a 25% gain in the last month alone. The annual gain comes to 129% following the latest surge, making investors sit up and take notice.

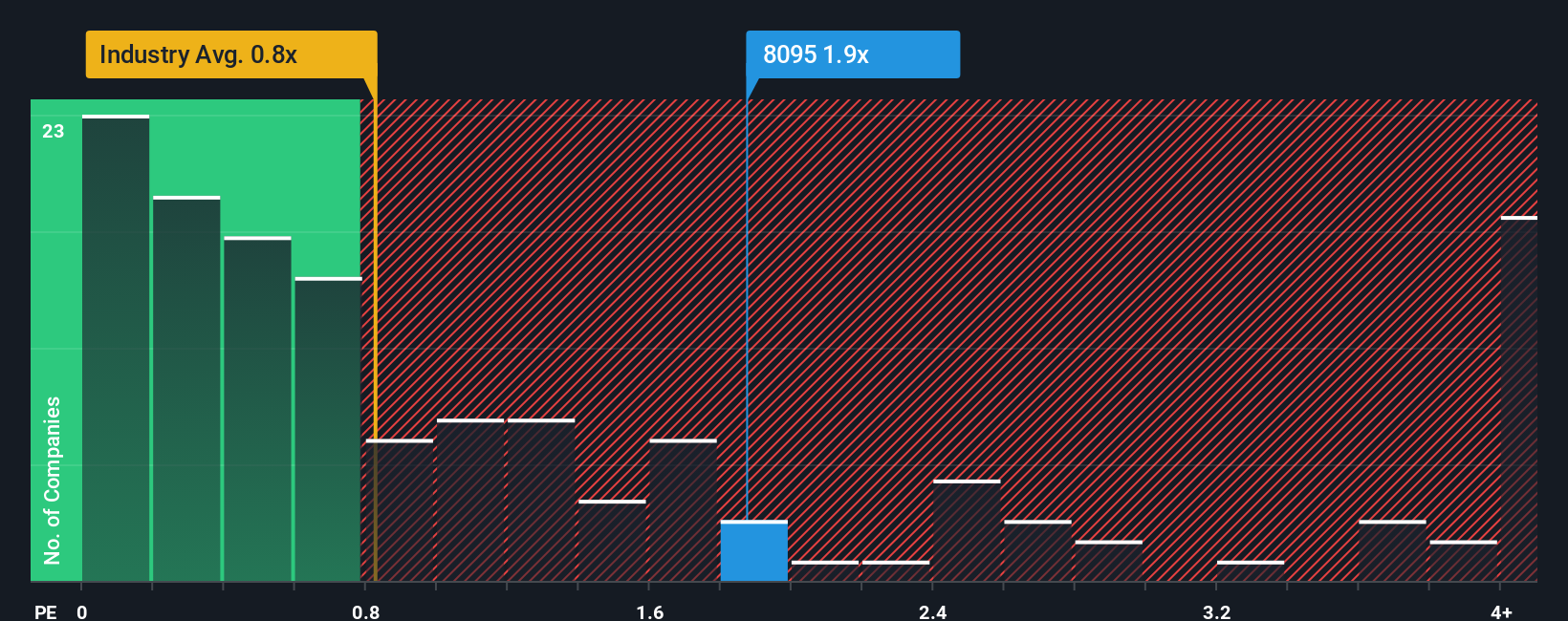

Following the firm bounce in price, when almost half of the companies in Hong Kong's Industrials industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Beijing Beida Jade Bird Universal Sci-Tech as a stock probably not worth researching with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Beijing Beida Jade Bird Universal Sci-Tech

What Does Beijing Beida Jade Bird Universal Sci-Tech's P/S Mean For Shareholders?

Beijing Beida Jade Bird Universal Sci-Tech has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Beijing Beida Jade Bird Universal Sci-Tech, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Beijing Beida Jade Bird Universal Sci-Tech?

In order to justify its P/S ratio, Beijing Beida Jade Bird Universal Sci-Tech would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.0%. This was backed up an excellent period prior to see revenue up by 111% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is only predicted to deliver 9.8% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Beijing Beida Jade Bird Universal Sci-Tech's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Beijing Beida Jade Bird Universal Sci-Tech shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Beijing Beida Jade Bird Universal Sci-Tech maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Beijing Beida Jade Bird Universal Sci-Tech, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English