Here's Why Shareholders May Consider Paying Dragon Rise Group Holdings Limited's (HKG:6829) CEO A Little More

Key Insights

- Dragon Rise Group Holdings to hold its Annual General Meeting on 29th of September

- Salary of HK$794.0k is part of CEO Yuk-Kit Yip's total remuneration

- Total compensation is 65% below industry average

- Dragon Rise Group Holdings' total shareholder return over the past three years was 0.6% while its EPS was down 20% over the past three years

The decent performance at Dragon Rise Group Holdings Limited (HKG:6829) recently will please most shareholders as they go into the AGM coming up on 29th of September. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for Dragon Rise Group Holdings

How Does Total Compensation For Yuk-Kit Yip Compare With Other Companies In The Industry?

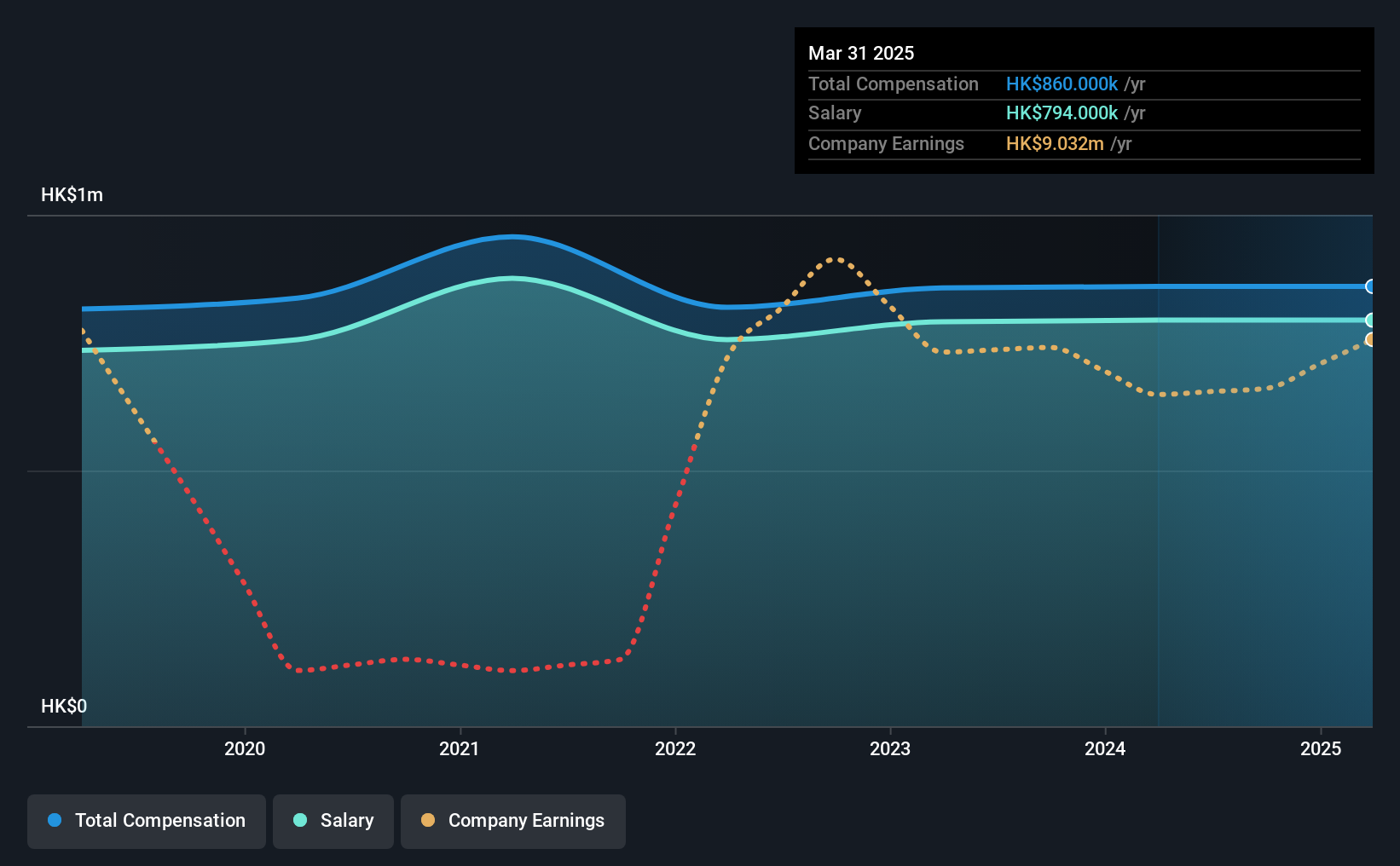

Our data indicates that Dragon Rise Group Holdings Limited has a market capitalization of HK$360m, and total annual CEO compensation was reported as HK$860k for the year to March 2025. This was the same amount the CEO received in the prior year. We note that the salary portion, which stands at HK$794.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the Hong Kong Construction industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$2.4m. Accordingly, Dragon Rise Group Holdings pays its CEO under the industry median. Moreover, Yuk-Kit Yip also holds HK$242m worth of Dragon Rise Group Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | HK$794k | HK$794k | 92% |

| Other | HK$66k | HK$66k | 8% |

| Total Compensation | HK$860k | HK$860k | 100% |

Speaking on an industry level, nearly 85% of total compensation represents salary, while the remainder of 15% is other remuneration. Dragon Rise Group Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Dragon Rise Group Holdings Limited's Growth

Dragon Rise Group Holdings Limited has reduced its earnings per share by 20% a year over the last three years. Its revenue is up 39% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Dragon Rise Group Holdings Limited Been A Good Investment?

With a total shareholder return of 0.6% over three years, Dragon Rise Group Holdings Limited has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for Dragon Rise Group Holdings you should be aware of, and 2 of them are a bit unpleasant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English