The Return Trends At Dragon Rise Group Holdings (HKG:6829) Look Promising

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, we've noticed some promising trends at Dragon Rise Group Holdings (HKG:6829) so let's look a bit deeper.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Dragon Rise Group Holdings is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.036 = HK$12m ÷ (HK$516m - HK$192m) (Based on the trailing twelve months to March 2025).

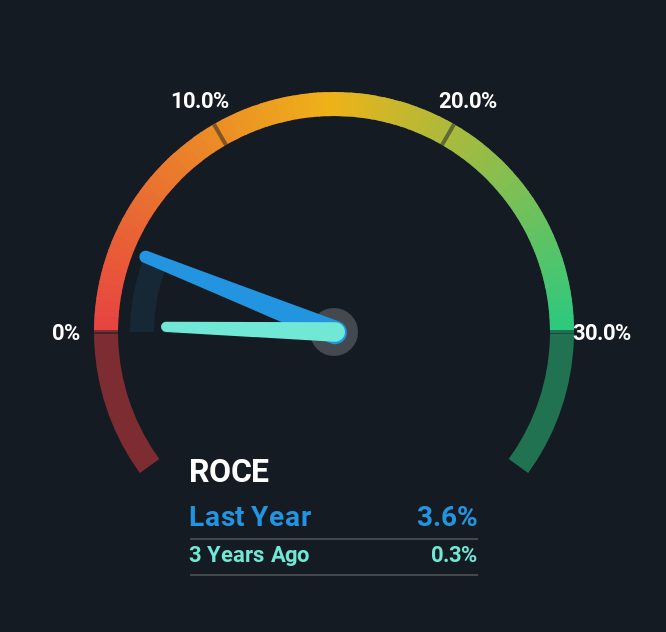

Thus, Dragon Rise Group Holdings has an ROCE of 3.6%. Ultimately, that's a low return and it under-performs the Construction industry average of 4.9%.

View our latest analysis for Dragon Rise Group Holdings

Historical performance is a great place to start when researching a stock so above you can see the gauge for Dragon Rise Group Holdings' ROCE against it's prior returns. If you're interested in investigating Dragon Rise Group Holdings' past further, check out this free graph covering Dragon Rise Group Holdings' past earnings, revenue and cash flow.

How Are Returns Trending?

Dragon Rise Group Holdings has broken into the black (profitability) and we're sure it's a sight for sore eyes. The company now earns 3.6% on its capital, because five years ago it was incurring losses. On top of that, what's interesting is that the amount of capital being employed has remained steady, so the business hasn't needed to put any additional money to work to generate these higher returns. So while we're happy that the business is more efficient, just keep in mind that could mean that going forward the business is lacking areas to invest internally for growth. So if you're looking for high growth, you'll want to see a business's capital employed also increasing.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. The current liabilities has increased to 37% of total assets, so the business is now more funded by the likes of its suppliers or short-term creditors. It's worth keeping an eye on this because as the percentage of current liabilities to total assets increases, some aspects of risk also increase.

The Bottom Line On Dragon Rise Group Holdings' ROCE

To bring it all together, Dragon Rise Group Holdings has done well to increase the returns it's generating from its capital employed. And investors seem to expect more of this going forward, since the stock has rewarded shareholders with a 46% return over the last five years. In light of that, we think it's worth looking further into this stock because if Dragon Rise Group Holdings can keep these trends up, it could have a bright future ahead.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 3 warning signs for Dragon Rise Group Holdings (of which 2 are concerning!) that you should know about.

While Dragon Rise Group Holdings isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English