Asian Market Spotlight: 3 Penny Stocks Under US$3B Market Cap

As global markets navigate a complex landscape marked by shifting trade policies and economic indicators, investors are increasingly looking toward Asia for unique opportunities. Penny stocks, though an older term, continue to capture the interest of those seeking growth potential in smaller or newer companies. By focusing on firms with strong balance sheets and solid fundamentals, investors can uncover valuable prospects in this segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.34 | THB4.29B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.45 | HK$914.88M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.48 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.55 | SGD222.91M | ✅ 4 ⚠️ 0 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.08 | HK$1.8B | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.87 | SGD11.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB1.02 | THB1.5B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.86 | THB9.82B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.59 | SGD984.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 978 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FIT Hon Teng (SEHK:6088)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$22.62 billion.

Operations: The company's revenue is generated from two main segments: Consumer Products, which contributed $685.67 million, and Intermediate Products, which accounted for $3.90 billion.

Market Cap: HK$22.62B

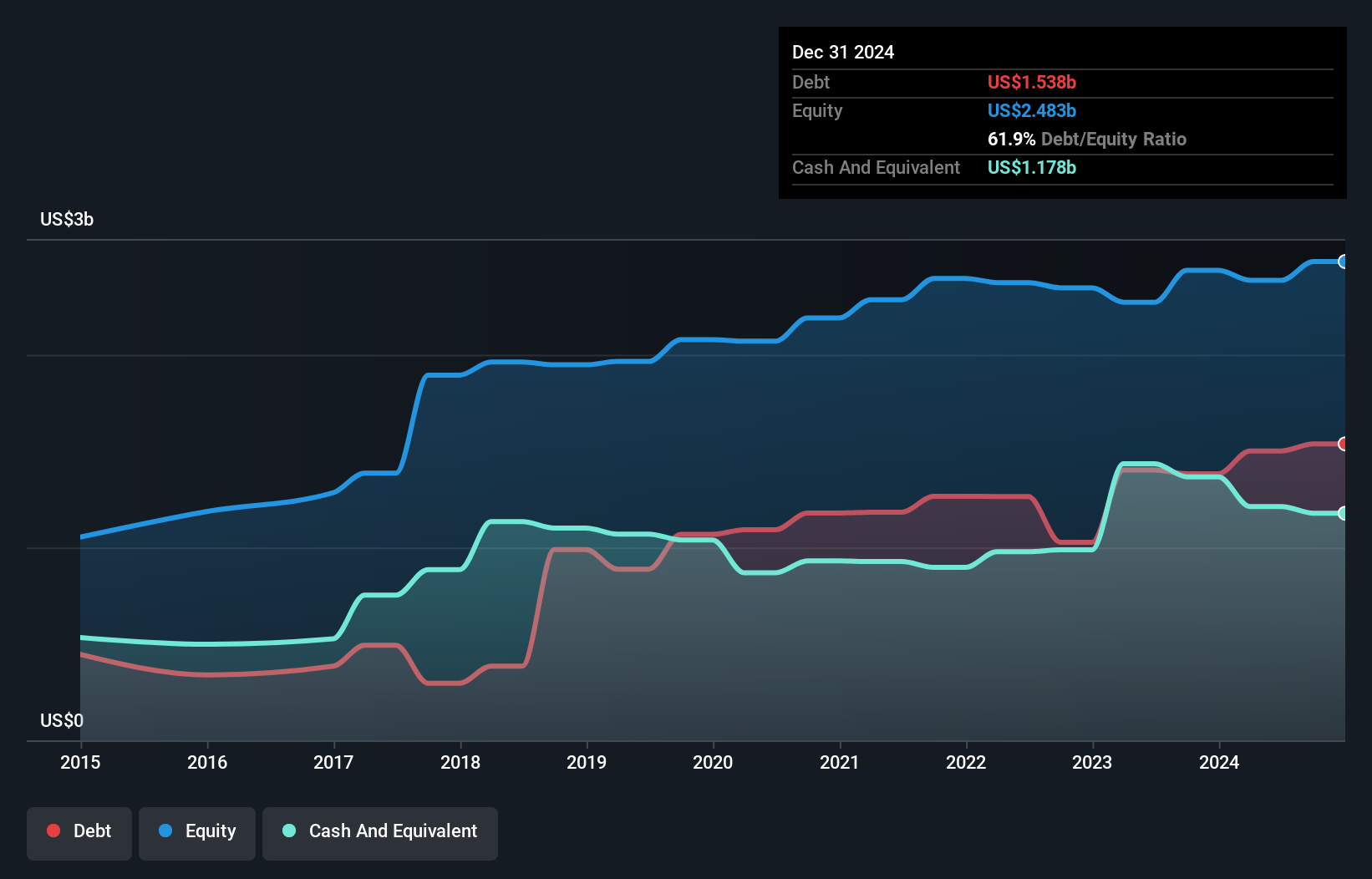

FIT Hon Teng Limited, with a market cap of HK$22.62 billion, has demonstrated solid financial management and growth potential. Its short-term assets of $3.2 billion comfortably cover both short- and long-term liabilities, while its net debt to equity ratio is satisfactory at 14.5%. Earnings have grown by 19.2% over the past year, outpacing the electronic industry average and showing an acceleration from its five-year growth rate of 2.3%. A recent strategic alliance with Point2 Technology aims to commercialize advanced interconnect solutions for AI clusters, potentially enhancing FIT's market position in high-performance data center technologies.

- Get an in-depth perspective on FIT Hon Teng's performance by reading our balance sheet health report here.

- Examine FIT Hon Teng's earnings growth report to understand how analysts expect it to perform.

Youzan Technology (SEHK:8083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Youzan Technology Limited, with a market cap of HK$4.95 billion, is an investment holding company that offers online and offline e-commerce solutions in China, Japan, and Canada.

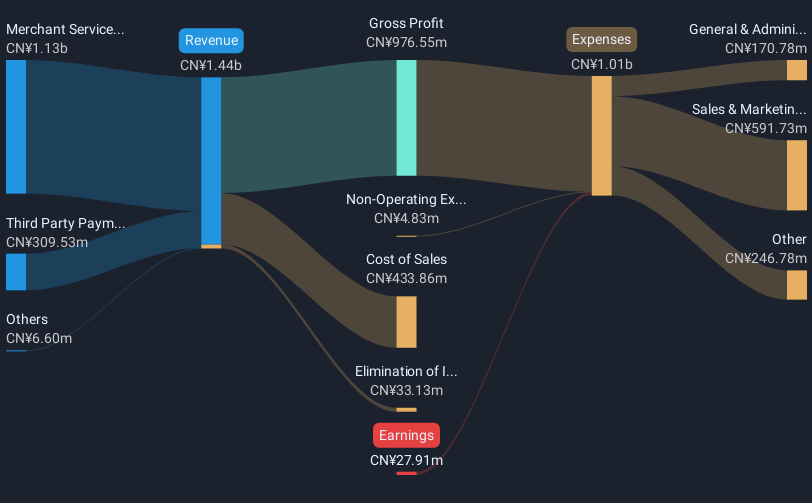

Operations: The company generates revenue primarily from Merchant Services, amounting to CN¥1.18 billion, and Third Party Payment Services, totaling CN¥313.19 million.

Market Cap: HK$4.95B

Youzan Technology Limited, with a market cap of HK$4.95 billion, is navigating its path to profitability with recent guidance indicating a profit turnaround for the first half of 2025. This shift is driven by increased revenue, adoption of AI tools enhancing operational efficiency, and the elimination of amortization expenses from past acquisitions. Despite being unprofitable historically, Youzan has maintained a stable cash runway exceeding three years due to positive free cash flow growth. The company has also initiated a significant share buyback program aimed at boosting net asset value and earnings per share, reflecting prudent financial management amidst volatility.

- Jump into the full analysis health report here for a deeper understanding of Youzan Technology.

- Gain insights into Youzan Technology's future direction by reviewing our growth report.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD11.30 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which accounts for CN¥25.07 billion, followed by the shipping segment at CN¥1.15 billion.

Market Cap: SGD11.3B

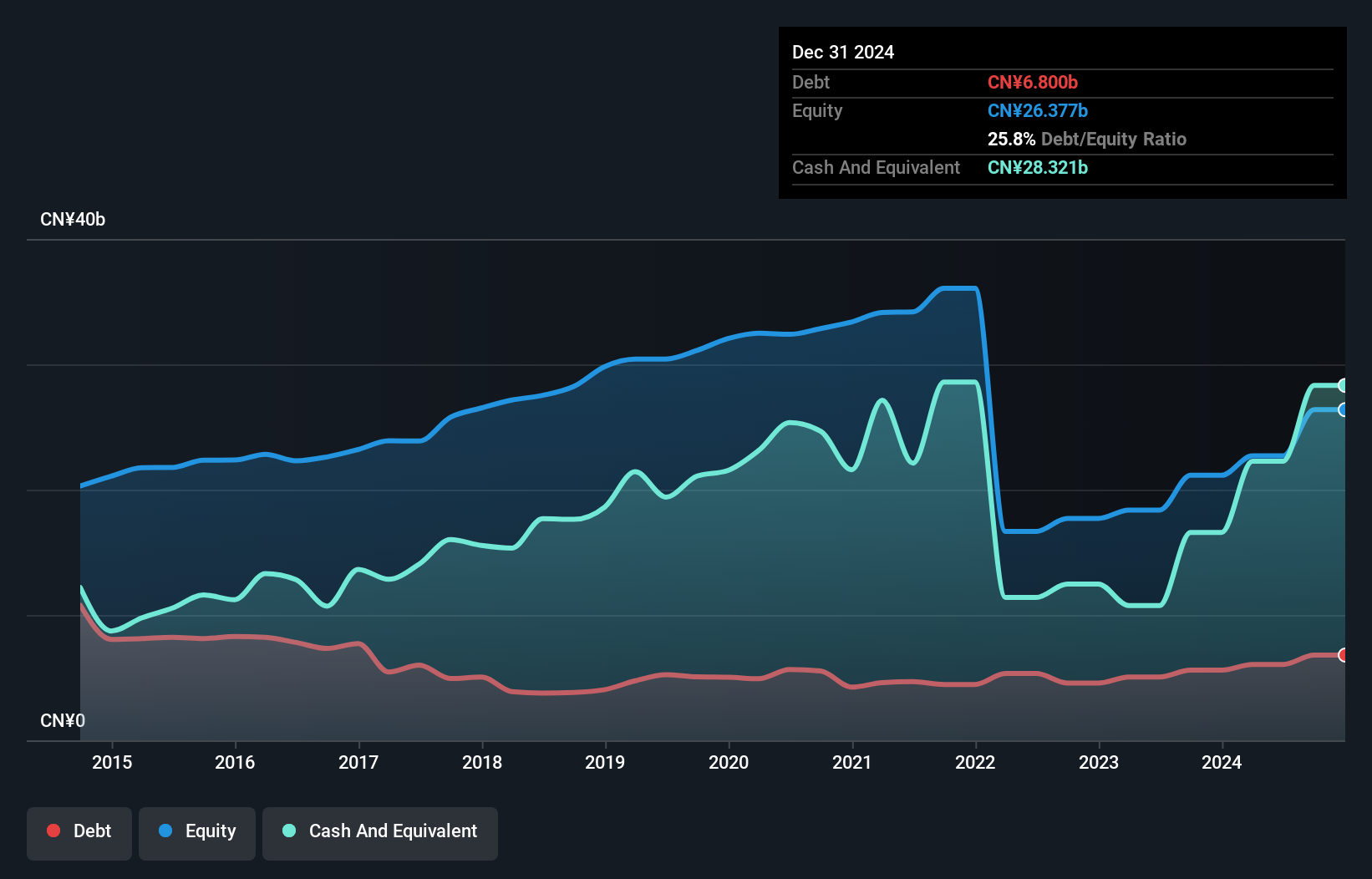

Yangzijiang Shipbuilding (Holdings) Ltd., with a market cap of S$11.30 billion, demonstrates strong financial health and growth potential. The company reported net income of CN¥4.18 billion for the half year ended June 2025, up from CN¥3.06 billion a year ago, reflecting robust earnings growth exceeding industry averages. It holds more cash than total debt and maintains high short-term asset coverage over liabilities, indicating solid liquidity management. Despite an increase in its debt-to-equity ratio over five years, operating cash flow comfortably covers its debt obligations. Trading significantly below estimated fair value and offering reliable dividends further enhances its investment appeal amidst market volatility.

- Click to explore a detailed breakdown of our findings in Yangzijiang Shipbuilding (Holdings)'s financial health report.

- Explore Yangzijiang Shipbuilding (Holdings)'s analyst forecasts in our growth report.

Seize The Opportunity

- Click this link to deep-dive into the 978 companies within our Asian Penny Stocks screener.

- Curious About Other Options? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English